Changing Assumptions Ltd. has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013. Funding during 2014 was $55,000. The actual value of pension fund assets at the end of 2014 was $2,171,000. As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a. Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014. Perform this computation for interest rates of 8%,10%,and 12%.

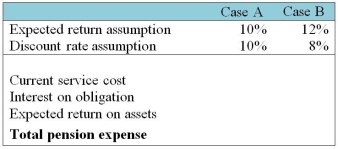

b. Derive the pension expense for 2014 under various assumptions about the expected return and discount rate. Complete the following table:

c. Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate. How does a change in the discount rate affect the accrued benefit obligation?

c. Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate. How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Classical Conditioning

A conditioning method wherein a response, at first prompted by a second stimulus, is eventually prompted by the first stimulus after multiple associations between the two.

Disulfiram (Antabuse)

An antagonist drug used in treating alcohol abuse or dependence.

Operant Conditioning

An educational method where the intensity of an action is altered by either rewards or penalties.

Biological Urge

Innate impulses or drives that influence behavior, such as the needs for food, water, or sexual activity.

Q5: verstehen

Q6: Burlington Corp. has a single class of

Q21: For stock splits and stock dividends,while it

Q21: Which statement does not explain the "two

Q27: legal harm

Q40: When does a company record dividends payable?<br>A)On

Q42: Which statement is not correct?<br>A)The accrual method

Q47: On May 1,2012,Janus Company entered into a

Q49: Which of the following component does NOT

Q86: How is the subsequent conversion of bonds