Changing Assumptions Ltd. has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013. Funding during 2014 was $55,000. The actual value of pension fund assets at the end of 2014 was $2,171,000. As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a. Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014. Perform this computation for interest rates of 8%,10%,and 12%.

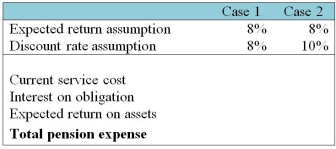

b. Derive the pension expense for 2014 under various assumptions about the expected return and discount rate. Complete the following table:

c. Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate. How does a change in the discount rate affect the accrued benefit obligation?

c. Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate. How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Black and/or Latino Urban Youngsters

Refers to young individuals of African American or Hispanic origin living in urban areas.

Immigrant Groups

Communities formed by people who have moved from one country to another, often sharing a common national or cultural identity.

People of Color

A term used to describe individuals of non-white racial or ethnic backgrounds, emphasizing diversity and the experiences of racial discrimination.

Termination and Relocation

Policies or practices related to ending programs, services, or statuses, and moving individuals, often forcibly, from one location to another.

Q2: replication

Q12: Which of the following is NOT one

Q18: What are actuarial losses or gains in

Q45: Here are the terms of a lease

Q55: What criterion is required for a "cash

Q56: Who coined the term "public sociology"?<br>A)Emile Durkheim<br>B)Herbert

Q59: The Russell Ogden case is an illustration

Q62: Which of the following characteristic is required

Q68: AnnuG Inc. granted 200,000 stock options to

Q73: A pension plan promises to pay $75,000