Changing Assumptions Ltd. has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013. Funding during 2014 was $55,000. The actual value of pension fund assets at the end of 2014 was $2,171,000. As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a. Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014. Perform this computation for interest rates of 8%,10%,and 12%.

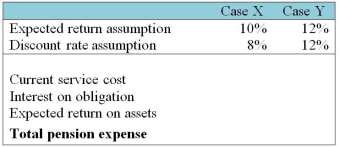

b. Derive the pension expense for 2014 under various assumptions about the expected return and discount rate. Complete the following table:

c. Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate. How does a change in the discount rate affect the accrued benefit obligation?

c. Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate. How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Merchandise on Credit

Goods that have been sold but not yet paid for, implying that the buyer owes the seller money.

Gross Amount

The gross amount is the total figure before any deductions are made, such as expenses, taxes, or discounts.

Journal Entries

Recorded transactions in the accounting journals that represent the financial activities of a company, detailing debits and credits for account adjustments.

Average Cost

A method of inventory valuation that calculates the cost of goods sold and ending inventory based on the weighted average cost of all items.

Q9: Which method does not use "temporary differences"

Q19: Which statement is accurate?<br>A)The taxes payable method

Q31: Which statement is correct about "par value"?<br>A)Par

Q34: research fraud

Q42: qualitative interview

Q49: Which of the following component does NOT

Q53: Identify whether the following characteristics/facts are

Q56: For the following lease,determine the minimum

Q59: historical research

Q63: selective observation