The following data represent the differences between accounting and tax income for Seafood Imports Inc.,whose pre-tax accounting income is $650,000 for the year ended December 31. The company's income tax rate is 45%. Additional information relevant to income taxes includes the following.

a. Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b. Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

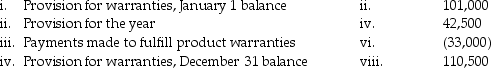

c. In a previous year,the company established a provision for product warranty expense. A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

For tax purposes,only actual amounts paid for warranties are deductible.

d. Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Requirement:

Prepare the journal entries to record income taxes for Seafood Imports.

Definitions:

Marginal Productivity Principle

An economic principle stating that employers will pay a wage equal to the additional value generated by the last unit of labor hired.

Profit-Maximizing Firm

A company's aim to achieve the highest possible profit through adjusting its production and pricing strategies.

Total Revenue

The total amount of money received by a company from its sales of goods or services.

Elastic Supply Schedule

A situation where the quantity supplied of a good changes significantly when its price changes.

Q17: Under the accrual method,what is the effect

Q26: Which of the following is not an

Q26: Which statement is correct for the past

Q32: Non-current debt instruments exchanged for assets are

Q37: structure

Q42: If 10,000 shares with par value of

Q43: Which statement is correct about "weighted average

Q51: For the following lease,determine the minimum

Q52: On May 1,2012,VeryFine LTD. provides a vendor

Q84: Which statement is correct about the "guaranteed