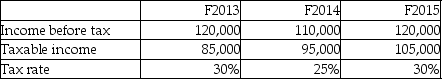

What is the deferred tax liability under the deferral method for F2014?

Definitions:

Convertible Preferred Stock

A type of preferred stock that offers the option to convert into a specified number of common shares, usually after a predetermined date.

APB Opinion No.14

An accounting guideline issued by the Accounting Principles Board addressing the accounting for convertible securities and the exercise of conversion options in financial statements.

Conversion Provision

A clause in a security or loan that allows the holder to convert into a different security, typically common stock, under certain conditions.

Callable Preferred Stock

Callable Preferred Stock is a type of preferred stock that gives the issuer the right to redeem the stock at a predetermined price after a specified date.

Q6: Financial information for Fesone Inc.'s balance

Q8: Which statement best explains a "leveraged buyout"?<br>A)A

Q20: Which of the following best describes a

Q24: unnecessary stress

Q30: Which method is used under IFRS to

Q36: mesosocial theory

Q37: What amount will be presented on the

Q38: Which statement is correct about financial leverage?<br>A)It

Q45: Indicate whether the item will result in

Q92: Compare the impact of finance leases and