Sad Man Inc. had 220,000 ordinary shares outstanding in all of 2013. On January 1,2011,Sad issued at par $400,000 in 10% bonds maturing on January 1,2019. Each $1,000 bond is convertible into 9 ordinary shares. Assume that the effective interest rate is 10%. There are 5,000 outstanding cumulative preferred shares that are each entitled to an annual dividend of $0.20. Dividends were not declared or paid during 2013. Each preferred share is convertible into three ordinary shares. Sad's net income for the year ended December 31,2013 was $250,000. Its income tax rate was 35%.

Requirements:

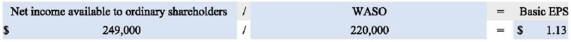

a. Calculate Sad's basic EPS for 2013.

b. Are the convertible bonds dilutive or anti-dilutive in nature? The convertible preferred shares?

c. Calculate Sad's diluted EPS for 2013.

Definitions:

Q6: According to the World Health Organization's (1978)definition,primary

Q6: Canaroo Inc. sold $800,000 of two-year bonds

Q13: Under the accrual method,what is the effect

Q18: The chart of a patient who has

Q20: Authors characterized the social determinants of health

Q39: What is a bond indenture?<br>A)Guarantee of the

Q51: Feldman has a defined benefit pension plan.

Q52: Discuss how the cash flow statement helps

Q59: Zarlon Leasing Company agrees on January 1,2012

Q62: Which of the following characteristic is required