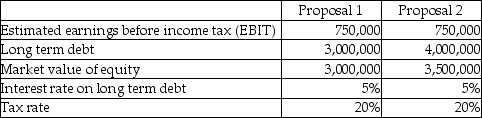

Universal Inc. is in the process of acquiring another business. In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity). The two proposals being contemplated are detailed below:

Requirements:

Requirements:

a. Calculate the estimated return on equity (ROE)under the two proposals. (ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b. Which proposal will generate the higher estimated ROE?

Definitions:

Sensitization

An increased reaction to a stimulus following repeated exposure to it, often leading to heightened sensitivity to related stimuli.

Habituation

The process by which an organism reduces its response to a repeated stimulus over time.

Higher-order Conditioning

A process in classical conditioning where a conditioned stimulus is paired with a new neutral stimulus, creating a second conditioned stimulus.

Modeling

The acquisition of behavior as a result of observing the experiences of others.

Q7: A company had a debt-to-equity ratio of

Q15: The nurse manager,as the leader of the

Q15: A company issues convertible bonds with face

Q18: How much tax expense would be recorded

Q21: As a unit manager, you chair the

Q29: Many factors affect decision-making such as bias.Which

Q29: Which is not a reason why companies

Q38: Which of the following component does NOT

Q41: Under IFRS,assuming all information is available,which rate

Q81: Breezy Lodge issued 25,000 at-the-money stock options