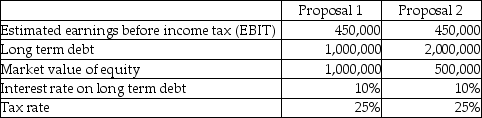

Blue Corp is in the process of acquiring another business. In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity). The two proposals being contemplated are detailed below:

Requirements

Requirements

a. Calculate the estimated return on equity (ROE)under the two proposals. (ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b. Which proposal will generate the higher estimated ROE?

c. What is the primary benefit of leveraging an investment decision? What are two drawbacks to leveraging an investment decision?

Definitions:

Fibrin

A protein involved in the blood clotting process, which works by forming a fibrous mesh that impedes the flow of blood.

Blood Vessel

Tubular structures carrying blood through the tissues and organs; a vein, artery, or capillary.

Blood Clot

A mass formed by the coagulation of blood in a part of the circulatory system, stopping bleeding or blocking a vessel.

Polycythemia Vera

A rare blood disorder characterized by an increased number of red blood cells, which can lead to an increased risk of blood clots, stroke, and heart attack.

Q1: Emily has completed an environmental scan.She is

Q14: Over the River Co. (OTRC)sells $1,200,000 of

Q15: To perform treatment on a patient not

Q43: If 1,000 shares with a par value

Q52: What are the components of the pension

Q65: How much tax expense would be recorded

Q77: A $100,000 5-year 6% bonds bond is

Q79: What amount is outside of the corridor

Q85: In the table below,choose the financial instrument

Q94: The following are some of the