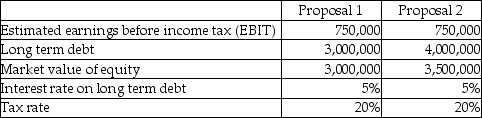

Universal Inc. is in the process of acquiring another business. In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity). The two proposals being contemplated are detailed below:

Requirements:

Requirements:

a. Calculate the estimated return on equity (ROE)under the two proposals. (ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b. Which proposal will generate the higher estimated ROE?

Definitions:

Volume Variance

An assessment of the impact of production or sales volume differences on a company's revenue or expenses, relative to budgeted amounts.

Q1: Assume that a company issued 10,000 shares

Q11: A nurse manager in one hospital is

Q18: Robert,an experienced nurse,discovered a medication order was

Q20: Which of the following is an intuitive

Q24: Which statement is not correct about financial

Q31: Which statement is correct about "par value"?<br>A)Par

Q34: If a company issues 2,000 shares for

Q39: Here is an extract of a trial

Q40: Explain how a change in the following

Q65: Dunst Company had the following shareholders'