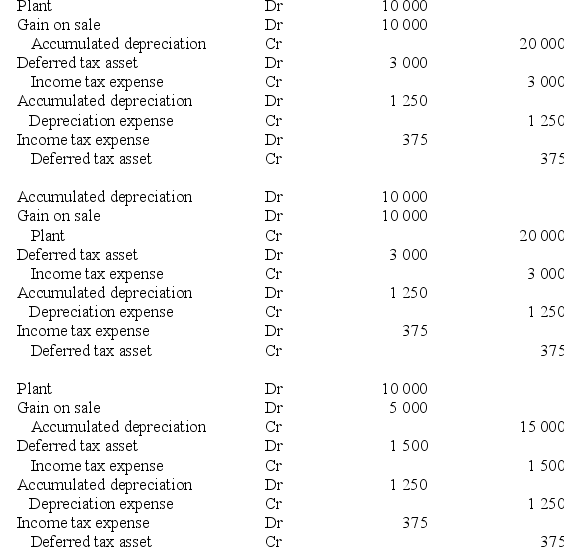

Abra Ltd sold an item of plant to its subsidiary Cadabra Ltd on 1 January 2017 for $50 000. The asset had cost Abra Ltd $60 000 when acquired on 1 January 2015. At that time the useful life of the plant was assessed at 6 years. Rounded to the nearest dollar, the consolidation elimination entries at 30 June 2017 in relation to the sale of plant are which of the following?

Definitions:

Serious Complaint

A grievance or objection raised concerning a significant issue, often requiring urgent attention or resolution.

FedEx Parcel

A package or shipment transported and delivered by FedEx, a global courier delivery services company.

Adjustment Refusal Message

A communication expressing the denial or rejection of a request for alteration or change.

Refusal

The act of declining, rejecting, or saying no to a request, offer, or proposition.

Q8: The formal documentation of a hedging relationship

Q9: When presenting the reconciliation from profit to

Q10: Which statement is most accurate regarding the

Q11: Easts Limited acquired 100% of the shares

Q12: The male client is experiencing a psychotic

Q17: Which potential client would a nurse identify

Q17: Goodwill acquired in an associate is:<br>A) amortised

Q26: Assets and liabilities to be received or

Q34: Where an entity directly holds more than

Q62: For a company, retained earnings represent:<br>A) contributed