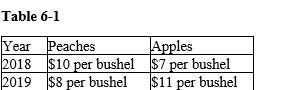

-Refer to Table 6-1. What was the inflation rate in 2019?

Definitions:

Current Tax Assets

Assets on the balance sheet representing taxes that are recoverable in the short term because taxes were paid in advance or too much tax was paid compared to the tax liability.

Tax Consolidation

A tax regime allowing corporate groups to be treated as a single entity for income tax purposes, facilitating tax planning and compliance.

Tax Liabilities

Obligations to pay taxes to government authorities as required by law, stemming from earning income or engaging in other taxable activities.

AASB3

An Australian Accounting Standard (AASB 3) that specifies the accounting requirements for business combinations, including how to account for goodwill and acquired identifiable assets and liabilities.

Q25: What is generally an opportunity cost of

Q61: Which nation experienced average rates of economic

Q69: In a given year, an economy has

Q94: What do international GDP and socioeconomic data

Q120: Cynthia is collecting unemployment insurance benefits. To

Q147: Peter tells you that he thinks the

Q156: Suppose a small closed economy has GDP

Q173: Which statement best describes a characteristic of

Q206: Which term refers to the fall in

Q247: What does the law of demand imply?<br>A)