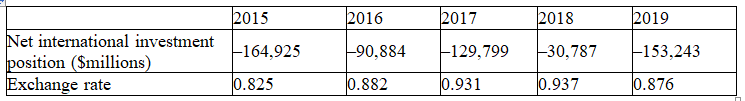

Suppose we measure Canada's net capital outflow by what Statistics Canada calls "net international investment position," and we approximate the real exchange rate of the dollar by the price of the Canadian dollar in terms of U.S. dollars. The following table gives some fictitious data on these two variables.

a. What does our open-economy macroeconomic model predict with regard to the relationship between net capital outflow and the real exchange rate?

b. Do you find evidence in the data to support the theory?

c. If you find discrepancies between the data and the theory, what could cause them?

Definitions:

Neurons

Nerve cells that transmit information through electrical and chemical signals in the body.

Pons

A part of the brainstem that links the medulla oblongata and the thalamus, involved in the control of breathing, communication between different parts of the brain, and sensations such as hearing, taste, and balance.

Leg-Muscle Movements

Physical actions involving the muscles in the legs, which can include walking, running, jumping, or other forms of locomotion or exercise.

Psychoactive Drugs

Substances that affect the mind, mood, or other mental processes, often used for medicinal, recreational, or spiritual purposes.

Q21: Refer to Figure 11-1. If the money

Q39: Which statement best predicts the effects of

Q62: What has been suggested as a cause

Q75: In the long run, what do changes

Q87: For Canada, the most important reason for

Q94: A decrease in the money supply causes

Q136: Where does the supply of dollars in

Q183: Make a list of things that would

Q206: Suppose the exchange rate is 5 units

Q213: In 1991, Canada was in a recession.