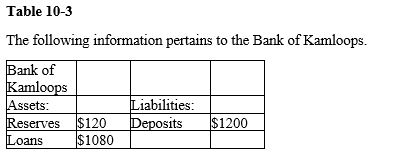

-Refer to Table 10-3. If the Bank of Canada requires banks to hold 5 percent of deposits as reserves, how much in excess reserves does the Bank of Kamloops now hold?

Definitions:

Option Contract

A contract which grants the holder the right to buy or sell an underlying asset at a predetermined price within a specified time frame.

Hedge Risk

A financial strategy used to limit or offset the probability of loss from fluctuations in the prices of currencies, commodities, or securities.

Speculate

The act of investing or trading in financial assets with high risk in anticipation of significant returns.

American Option

A type of options contract that allows holders to exercise the option at any time up to and including the expiration date.

Q18: When making investment decisions, which of the

Q18: How many unpaired electrons would you expect

Q28: optical<br>A)[Cr(en)<sub>3</sub>]<sup>3+</sup><br>B)[Zn(NH<sub>3</sub>)<sub>2</sub>Cl<sub>2</sub>]Br<sub>2 and </sub>[Zn(NH<sub>3</sub>)<sub>2</sub>Br<sub>2</sub>]Cl<sub>2</sub><br>C)[Ni(CN)<sub>2</sub>(OH)<sub>2</sub>]<sup>2-</sup><br>D)[Cr(NH<sub>3</sub>)<sub>3</sub>(CO)<sub>3</sub>]<sup>3+</sup><br>E)[Cu(SCN)<sub>4</sub>]<sup>3- </sup>and<sup> </sup>[Cu(NCS)<sub>4</sub>]<sup>3-</sup>

Q31: Which of the following is an example

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7901/.jpg" alt=" A)aspartic acid B)lysine

Q44: Monosaccharide units are bonded together to form

Q85: Which of the following compounds is an

Q96: Which one of the following molecules is

Q155: Which statement best describes the evolution of

Q196: In 2019, Denmark had net exports of