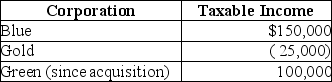

Blue and Gold Corporations are members of the Blue-Gold affiliated group, which filed a consolidated tax return for last year, reporting a $200,000 consolidated NOL. Small taxable income amounts were reported by Blue and Gold in separate tax returns filed in years prior to last year. Early in the current year, 100% of Blue's stock is purchased by Robert Martin who contributes additional funds to Blue Corporation sufficient to acquire all of Green Corporation's stock. For the current year, the affiliated group reports the following results (excluding the consolidated NOL deduction) :  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Auctions

Competitive bidding processes where goods or services are sold to the highest bidder.

Winner's Curse

The tendency of auction winners to have paid more than the item's actual value, often due to competitive bidding and overestimation of worth.

Bid Shading

A strategy in auctions where bidders intentionally bid lower than their actual value to increase the chance of winning at a lower price.

Bid-rigging

A form of fraud where competitors conspire to determine the winner of a bidding process, undermining fair competition.

Q4: According to Ressler,Burgess,and Douglas,approximately what percentage of

Q17: Which of the following corporations is entitled

Q26: Which of the following corporations is an

Q32: What do criticisms of the guilty knowledge

Q48: Which of the following is not reported

Q49: Parent Corporation owns 100% of the single

Q50: Which of the following was characteristic of

Q66: Identify which of the following statements is

Q84: Francine Corporation reports the following income and

Q99: In a complete liquidation of a corporation,