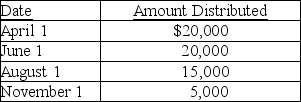

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year. Current E&P is $20,000. During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Hamdi v. Rumsfeld

A landmark Supreme Court case decided in 2004 that recognized the power of the government to detain enemy combatants, including U.S. citizens, but also established detainees' rights to challenge their detention.

Foreign Intelligence

Information relating to the capabilities, intentions, or activities of foreign governments or non-state actors.

Departmentalist

A theory in U.S. constitutional law holding that each branch of the government has the authority to interpret the Constitution in its administration of its own powers.

Supreme Court Interpreter

The term "Supreme Court interpreter" generally refers to the role of the Supreme Court in interpreting the Constitution, laws, and statutes of the United States.

Q13: Bat Corporation distributes stock rights with a

Q19: For Sec. 351 purposes, the term "property"

Q35: Identify which of the following statements is

Q41: Property received in a corporate liquidation by

Q49: Outline Heilbrun's conceptualization of training in forensic

Q51: The definition of a partnership does not

Q59: To avoid the accumulated earnings tax, a

Q64: Jerry transfers two assets to a corporation

Q75: The gross estate of a decedent contains

Q78: Which of the following results in a