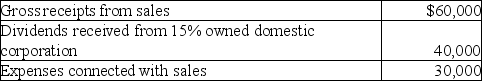

Island Corporation has the following income and expense items for the year:  The taxable income of Island Corporation is

The taxable income of Island Corporation is

Definitions:

Blood Glucose

The concentration of glucose present in the blood, a vital energy source for the body's cells.

Triglycerides

A type of fat found in the blood, which, in high levels, can increase the risk of heart disease.

Moderate Intensity

A level of exercise or physical activity that raises the heart rate and induces sweating, yet allows one to carry on a conversation.

Omega-3

A type of essential fatty acid found in fish oils and certain plant oils, beneficial for heart health and brain function.

Q1: The City of Portland gives Data Corporation

Q18: Identify which of the following statements is

Q30: Identify which of the following statements is

Q41: Compare the foreign tax payment claimed as

Q43: For purposes of determining current E&P, which

Q59: To avoid the accumulated earnings tax, a

Q60: Ball Corporation owns 80% of Net Corporation's

Q62: Maple Corporation distributes land to a noncorporate

Q104: Miller Corporation has gross income of $100,000,

Q104: Jeremy operates a business as a sole