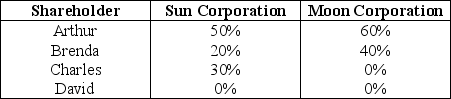

Sun and Moon Corporations each have only one class of stock outstanding. Their stock ownership is shown below.  Which of the four stock ownership changes that are illustrated is the minimum change that is needed if Sun and Moon Corporations are to be brother-sister corporations under the 50%-80% requirements? (Assume the two corporations are equally valued.)

Which of the four stock ownership changes that are illustrated is the minimum change that is needed if Sun and Moon Corporations are to be brother-sister corporations under the 50%-80% requirements? (Assume the two corporations are equally valued.)

Definitions:

Intangible Objects

Non-physical assets such as intellectual property, rights, and licenses that have value and can be owned or transferred.

Ascertainable Value

A value that can be precisely determined or measured.

Limited Liability Company

A corporate framework blending the direct taxation feature of a partnership and the restricted liability characteristic of a corporation.

Unmarried Partner

An individual in a committed romantic relationship who lives with another individual without being legally married to them.

Q6: The FMV of an asset for gift

Q27: Corporate estimated tax payments are due April

Q46: Identify which of the following statements is

Q50: Identify which of the following statements is

Q54: Rocky is a party to a tax-free

Q73: Identify which of the following statements is

Q79: Corporations recognize gains and losses on the

Q84: Alan, a U.S. citizen, works in Germany

Q92: Identify which of the following statements is

Q96: For purposes of trust administration, the term