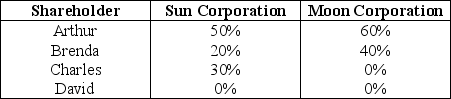

Sun and Moon Corporations each have only one class of stock outstanding. Their stock ownership is shown below.  Which of the four stock ownership changes that are illustrated is the minimum change that is needed if Sun and Moon Corporations are to be brother-sister corporations under the 50%-80% requirements? (Assume the two corporations are equally valued.)

Which of the four stock ownership changes that are illustrated is the minimum change that is needed if Sun and Moon Corporations are to be brother-sister corporations under the 50%-80% requirements? (Assume the two corporations are equally valued.)

Definitions:

Taxes

Compulsory financial charges or other levies imposed on an individual or a company by a governmental organization in order to fund various public expenditures.

Discretionary Income

Discretionary income is the amount of an individual's income that is left for spending, investing, or saving after taxes and personal necessities have been paid.

Disposable Income

The amount of money an individual or household has available for spending and saving after taxes have been deducted.

Net Income

The total earnings or profit of a business after subtracting all expenses, taxes, and costs.

Q20: What are the advantages and disadvantages of

Q22: Identify which of the following statements is

Q43: The City of Springfield donates land worth

Q49: Hogg Corporation distributes $30,000 to its sole

Q76: A trust reports the following results:<br>Allocable to<br>Income

Q77: Dave, Erica, and Faye are all unrelated.

Q80: Identify which of the following statements is

Q84: Identify which of the following statements is

Q105: The exemption amount for an estate is<br>A)

Q113: Island Corporation has the following income and