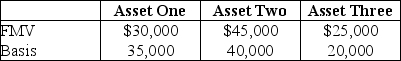

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec. 351.  Max's recognized gain is

Max's recognized gain is

Definitions:

Decreases Equity

Activities or transactions that reduce the owner's equity in a company, often through expenses, losses, or distributions to owners.

Earned Revenue

Earned revenue is income a company generates from its business activities, such as sales of goods or services, indicating work completed and value provided to customers.

Rights Of Creditors

Legal entitlements of creditors to receive payment from a debtor or claim on the assets of a debtor in case of default.

Rights Of Owners

Entitlements or privileges that come with owning equity or shares in a corporation, including voting rights, dividends, and the right to share in the assets of the company during liquidation.

Q3: Sun and Moon Corporations each have only

Q7: Which of the following entities is subject

Q19: For Sec. 351 purposes, the term "property"

Q21: If a state has adopted the Revised

Q26: The courts and the Treasury Regulations have

Q51: Guinness Corporation, a U.S. corporation, began operating

Q59: For the foreign credit limitation calculation, income

Q61: Which of the following transfers is subject

Q63: Moya Corporation adopted a plan of liquidation

Q114: Which of the following items will not