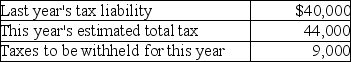

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits. Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty. Assume your client's adjusted gross income last year was $140,000.

Definitions:

Fictive Kin

Close relations with people we consider “like family” but who are not related to us by blood or marriage.

Fictive Kin

Non-biological relationships that are recognized as functionally equivalent to family ties due to their emotional or social significance.

Nuclear Family

A family unit consisting of two parents and their children, considered the smallest, most basic social unit in many societies.

Types Of Ties

Various forms of connections or relationships between individuals or entities, such as social, familial, or professional links.

Q15: Jack transfers property worth $250,000 to a

Q20: Martha died and by her will, specifically

Q54: How does a shareholder classify a distribution

Q56: Cactus Corporation, an S corporation, had accumulated

Q66: A qualified disclaimer is a valuable estate

Q66: Which of the following statements is correct?<br>A)

Q66: Tax return preparers can be penalized for

Q76: In which of the situations below will

Q83: U.S. citizens and resident aliens working abroad

Q91: The transferor's holding period for any boot