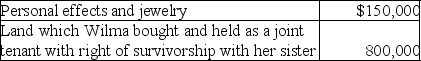

Following are the fair market values of Wilma's assets at her date of death:  The executor of Wilma's estate did not elect the alternate valuation date. The amount includible in Wilma's gross estate is

The executor of Wilma's estate did not elect the alternate valuation date. The amount includible in Wilma's gross estate is

Definitions:

Corporate Tax Rate

The percentage of a corporation's profits that is paid to the government as tax, varying by country and sometimes by the size or type of business.

Enterprise Multiple

A ratio used to determine the value of a company that takes into account its debt and equity, calculated by dividing the enterprise value by EBITDA.

EBIT

Known as Earnings Before Interest and Taxes, this financial gauge calculates a firm's profitability without considering interest and income tax charges.

Average Collection Period

The average number of days it takes for a company to collect payments from its customers, a measure of the efficiency of its credit policies.

Q5: Distributable net income (DNI) does not include

Q19: Identify which of the following statements is

Q26: Potter Corporation reports the following results for

Q29: Gerald requests an extension for filing his

Q35: Business assets of a sole proprietorship are

Q39: Identify which of the following statements is

Q79: Identify which of the following statements is

Q80: In which courts may litigation dealing with

Q100: Boxer Corporation, a C corporation, elects on

Q105: Discuss the purpose of the gift tax