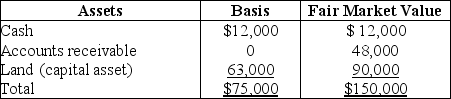

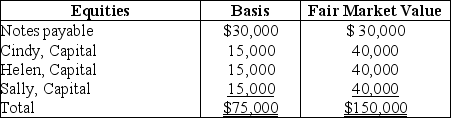

The CHS Partnership's balance sheet presented below is prepared on a cash basis at September 30 of the current year.

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is $25,000. What gain/loss should she report for tax purposes?

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is $25,000. What gain/loss should she report for tax purposes?

Definitions:

Black Market Activities

Transactions that take place outside of officially sanctioned channels, often illegal or unregulated by the government.

Market Efficiency

The degree to which market prices reflect all available, relevant information, leading to optimal allocation of resources.

Quota

A regulatory limit on the quantity or value of a particular product that can be traded or produced.

Price Floor

A government or group-imposed price control that sets the minimum price at which a product can be sold.

Q14: Mary died this year. Her will creates

Q15: Differences between taxable income and pretax accounting

Q15: Jack transfers property worth $250,000 to a

Q21: Identify which of the following statements is

Q27: Identify which of the following statements is

Q38: A company has four "deferred income tax"

Q43: A partner's holding period for property distributed

Q45: Which of the following citations is the

Q89: In 2001, Polly and Fred, brother and

Q99: Five years ago, George and Jerry (his