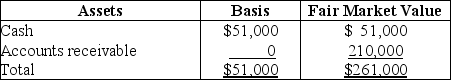

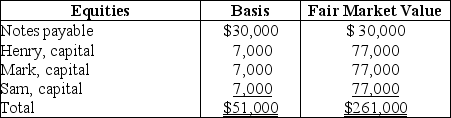

The HMS Partnership, a cash method of accounting entity, has the following balance sheet at December 31 of last year:

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities) at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities) at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Definitions:

Repayment

The act of paying back money previously borrowed from a lender.

Semiannually

Occurring or done twice a year, typically every six months.

Debt Investments

Investments in bonds or other forms of debt securities that provide the investor with interest income.

Bonds

Fixed income investments representing a loan made by an investor to a borrower, typically corporate or governmental, which pays periodic interest payments and returns the principal at maturity.

Q17: Identify which of the following statements is

Q19: The inclusion of MD&A (Management Discussion and

Q29: Proceeds of a life insurance policy payable

Q39: On December 31, Kate sells her 20%

Q49: Discuss three general provisions of the Sarbanes-Oxley

Q50: The gift tax is a wealth transfer

Q68: When computing the federal estate tax liability

Q84: Hu makes a gift of his home

Q90: When a court discusses issues not raised

Q99: What is the penalty for a tax