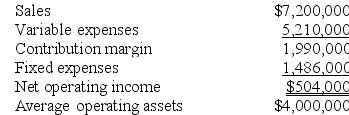

Wolley Inc. reported the following results from last year's operations:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1. What was last year's margin? (Round to the nearest 0.1%.)

2. What was last year's turnover? (Round to the nearest 0.01.)

3. What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4. What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5. What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6. What is the ROI related to this year's investment opportunity? (Round to the nearest 0.1%.)

7. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9. If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall ROI will this year? (Round to the nearest 0.1%.)

10. If Westerville's chief executive officer earns a bonus only if the ROI for this year exceeds the ROI for last year, would the CEO pursue the investment opportunity? Would the owners of the company want the CEO to pursue the investment opportunity?

Definitions:

Levels of Activity

Refers to the varying degrees of operation volume or intensity within a business.

Generally Accepted Accounting Principles

A set of accounting standards and practices that are widely used and accepted in the preparation of financial statements in the United States.

Budgeted Selling

The projected or planned selling expenses over a specific period, often used in financial planning.

Sales Revenue

The primary source of revenue in a merchandising company.

Q10: Queue time is considered non-value-added time.

Q21: Sade Inc. has provided the following data

Q37: Withdrawals and expenses are reported on the

Q44: Expenses are recorded when paid.

Q59: Some investment opportunities that should be accepted

Q80: When used in return on investment (ROI)

Q97: Hazy Shades received and paid a utility

Q152: Which of the following segment performance

Q162: Polaco Corporation makes a product that has

Q171: Handerson Corporation makes a product with the