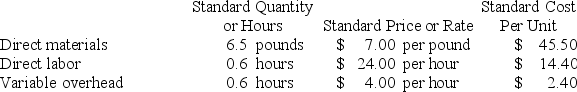

Kartman Corporation makes a product with the following standard costs:  In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.

In June the company's budgeted production was 3,400 units but the actual production was 3,500 units. The company used 22,150 pounds of the direct material and 2,290 direct labor-hours to produce this output. During the month, the company purchased 25,400 pounds of the direct material at a cost of $170,180. The actual direct labor cost was $57,021 and the actual variable overhead cost was $8,931.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for June is:

Definitions:

IFRS

International Financial Reporting Standards, a set of accounting guidelines that govern how financial statements are prepared worldwide.

GAAP

GAAP stands for Generally Accepted Accounting Principles, which are a set of rules and standards used in financial reporting and accounting in the United States.

Impairment Losses

The decrease in an asset's net carrying value that exceeds its recoverable amount.

Held-to-Maturity

A classification for investment securities that a company intends and has the ability to hold until they mature.

Q4: Leist Clinic uses client-visits as its measure

Q29: The direct labor standards for a particular

Q96: The purchase of equipment with both cash

Q105: Poorly trained workers could have an

Q106: Hubbard Kennel uses tenant-days as its measure

Q155: The increase or decrease in the owner's

Q169: The financial statement that shows business results

Q172: Younker Corporation is a shipping container refurbishment

Q204: Dirickson Inc. has provided the following data

Q363: Lawes Corporation manufactures and sells a single