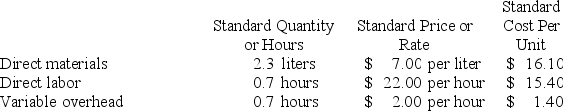

Miguez Corporation makes a product with the following standard costs:  The company budgeted for production of 2,600 units in September, but actual production was 2,500 units. The company used 5,440 liters of direct material and 1,680 direct labor-hours to produce this output. The company purchased 5,800 liters of the direct material at $7.20 per liter. The actual direct labor rate was $24.10 per hour and the actual variable overhead rate was $1.90 per hour.

The company budgeted for production of 2,600 units in September, but actual production was 2,500 units. The company used 5,440 liters of direct material and 1,680 direct labor-hours to produce this output. The company purchased 5,800 liters of the direct material at $7.20 per liter. The actual direct labor rate was $24.10 per hour and the actual variable overhead rate was $1.90 per hour.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for September is:

Definitions:

Product Costs

Costs that are directly associated with the creation of a product, including materials, labor, and manufacturing overhead.

Activity-Based Costing

A pricing technique that allocates overhead and indirect expenses to corresponding products and services according to the activities they necessitate.

Plantwide Factory Overhead Allocation

Plantwide factory overhead allocation involves spreading all of the indirect costs of operating a manufacturing plant across all products based on a single cost driver.

Plantwide Factory Overhead Rate

This rate calculates the total factory overhead for a plant as a single rate, which is then applied to allocate overhead costs to different products.

Q13: Which of the following would have claims

Q45: Saxena Corporation makes a product that has

Q61: The following data have been provided by

Q138: How does the purchase of equipment on

Q150: Minar Inc. reported the following results

Q185: Bailey Corporation manufactures orange safety suits for

Q213: The labor rate variance measures the difference

Q234: Courington Detailing's cost formula for its materials

Q344: Pickrel Corporation is an oil well service

Q355: Hirons Air uses two measures of activity,