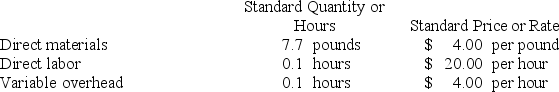

Milar Corporation makes a product with the following standard costs:  In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The labor rate variance for January is:

Definitions:

Joint Venture

A business agreement between two or more parties to combine resources for a specific project or business activity, sharing risks and rewards.

Tenants in Common

A form of co-ownership where each party owns a specific fraction of the property and can pass their share to heirs.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset over its useful life.

Q1: Devoto Inc. has provided the following data

Q38: Net income appears on which of the

Q43: Skoff Corporation is a shipping container refurbishment

Q45: A transaction can occur which will affect

Q68: The standard cost card for one unit

Q89: Determine the beginning owner's equity of a

Q124: Rogstad Corporation manufactures and sells a single

Q131: The statement of owner's equity is the

Q265: Schoening Corporation is a shipping container refurbishment

Q314: Taussig Snow Removal's cost formula for its