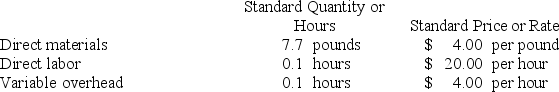

Milar Corporation makes a product with the following standard costs:  In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead efficiency variance for January is:

Definitions:

Reselling Products

The act of selling a product again, often after buying it from the original seller or manufacturer at a discounted rate.

In-store Demonstrations

Live presentations of a product's functionality and benefits conducted within a retail environment to attract customers and boost sales.

Promote Products

Marketing actions taken to increase awareness and sales of a product or service.

Distributor's Salespeople

Personnel employed by a distributor who are responsible for promoting and selling the distributor's products to retailers or end customers.

Q21: Sade Inc. has provided the following data

Q129: Salvey Inc. reported the following results from

Q133: The management of International Cookwares believes

Q139: Agustin Industries is a division of a

Q146: Kartman Corporation makes a product with the

Q159: Mike Corporation uses residual income to evaluate

Q168: Which of the following would not be

Q231: During June, Montera Clinic budgeted for 3,800

Q304: Manter Corporation manufactures and sells a single

Q320: Kaina Clinic uses client-visits as its measure