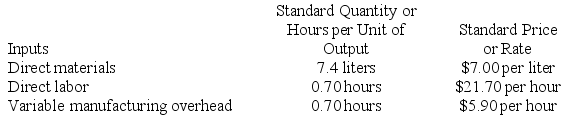

Kropf Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

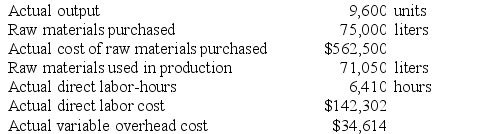

The company has reported the following actual results for the product for September:

The company has reported the following actual results for the product for September:

Required:

Required:

a. Compute the materials price variance for September.

b. Compute the materials quantity variance for September.

c. Compute the labor rate variance for September.

d. Compute the labor efficiency variance for September.

e. Compute the variable overhead rate variance for September.

f. Compute the variable overhead efficiency variance for September.

Definitions:

Bad Debt Expense

An accounting term representing the amount of revenue considered uncollectible from customers or clients, typically recorded as an expense.

Credit Sales

Sales made on credit, allowing customers to purchase goods or services and pay at a later date.

Allowance for Doubtful Accounts

A contra-asset account that represents the estimated portion of accounts receivable which may not be collected due to customer defaults.

Bad Debt Expense

The cost recognized by a company because of the expectation that certain accounts receivable will not be collected.

Q57: Legal services were provided to a credit

Q59: Higgs Enterprise's flexible budget cost formula for

Q71: Dacker Products is a division of

Q72: Brong Corporation is a shipping container refurbishment

Q206: Majer Corporation makes a product with the

Q316: Virgen Kennel uses tenant-days as its measure

Q338: Hallet Corporation manufactures and sells a single

Q352: Malander Kennel uses tenant-days as its measure

Q353: Isadore Hospital bases its budgets on patient-visits.

Q372: Laizure Clinic uses patient-visits as its measure