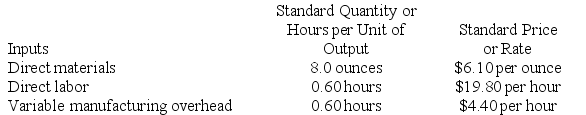

Fortes Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

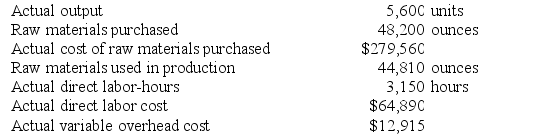

The company has reported the following actual results for the product for April:

The company has reported the following actual results for the product for April:

Required:

Required:

a. Compute the materials price variance for April.

b. Compute the materials quantity variance for April.

c. Compute the labor rate variance for April.

d. Compute the labor efficiency variance for April.

e. Compute the variable overhead rate variance for April.

f. Compute the variable overhead efficiency variance for April.

Definitions:

Multiple-Step

An income statement format that separates operating revenues and expenses from non-operating ones to calculate net income.

Operating Expenses

Costs associated with the daily operations of a business, excluding cost of goods sold, directly related to generating revenue.

Nonoperating Activities

Nonoperating activities involve the revenues and expenses that are not related to the core operations of a business.

Gross Profit Rate

The ratio of gross profit to net sales, expressing the percentage of revenue that exceeds the cost of goods sold.

Q33: Which of the following statements is TRUE?<br>A)

Q45: Rients Corporation is a service company that

Q59: Waste on the production line will result

Q69: Motts Inc. has a standard cost system

Q99: Cabell Products is a division of a

Q103: Doogan Corporation makes a product with the

Q137: The Casket Division of Saal Corporation had

Q139: A total of 6,850 kilograms of a

Q157: Which of the following measures of performance

Q319: If the actual level of activity is