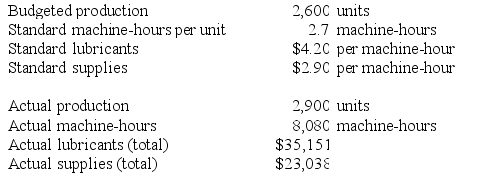

The following data have been provided by Lopus Corporation:

Required:

Required:

Compute the variable overhead rate variances for lubricants and for supplies. Indicate whether each of the variances is favorable (F) or unfavorable (U). Show your work!

Definitions:

FICA Withholding

The process by which employers withhold social security and Medicare taxes from their employees' paychecks, contributing to the FICA taxes owed.

Social Security Limit

The maximum amount of earnings on which Social Security payroll taxes are levied, also affecting the amount that can be received as Social Security benefits.

AGI

Adjusted Gross Income is your gross income minus allowable deductions, used to determine your taxable income on your federal income tax return.

Estimated Taxes

Periodic advance payments of taxes on income that is not subject to withholding, such as earnings from self-employment, interest, dividends, and rental income.

Q41: Descamps Inc. has provided the following data

Q42: Malander Kennel uses tenant-days as its measure

Q48: Dustman Manufacturing Corporation's most recent production budget

Q57: Crocetti Corporation makes one product and has

Q103: Doogan Corporation makes a product with the

Q119: At Rost Corporation, indirect labor is a

Q184: In the merchandise purchases budget, the required

Q198: Amirault Manufacturing Corporation has a standard cost

Q335: Sharifi Hospital bases its budgets on patient-visits.

Q370: Harold Corporation manufactures and sells a single