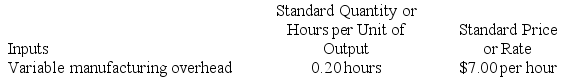

Sade Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.

The company has reported the following actual results for the product for December:

The company has reported the following actual results for the product for December:

Required:

Required:

a. Compute the variable overhead rate variance for December.

b. Compute the variable overhead efficiency variance for December.

Definitions:

Specified Period

A particular duration or timeframe set out in a financial agreement or investment term.

Strike Price

The fixed price at which the owner of an option can purchase (in the case of a call option) or sell (in the case of a put option) the underlying security or commodity.

Risk-Free Rate

The rate of return on an investment with zero risk, typically associated with government bonds, serving as a baseline for evaluating investment risk.

Put Option

A financial contract giving the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time.

Q7: Teel Printing uses two measures of activity,

Q78: Lawes Corporation manufactures and sells a single

Q86: Return on investment (ROI) equals margin multiplied

Q101: The following data are for the

Q154: All of Pocast Corporation's sales are on

Q164: The basic objective of responsibility accounting is

Q244: The Bowden Corporation makes a single product.

Q345: Mcdougald Corporation is a service company that

Q356: Kawamura Kennel uses tenant-days as its measure

Q416: Varriano Corporation bases its budgets on the