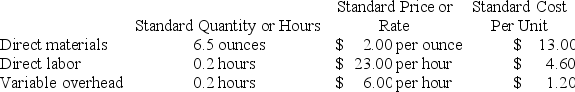

Tharaldson Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in June.

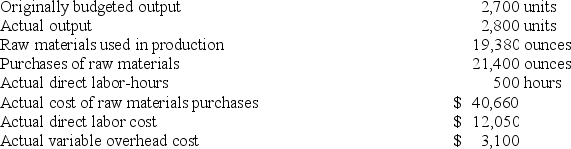

The company reported the following results concerning this product in June. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The materials price variance for June is:

Definitions:

Self-employment Taxes

Taxes that self-employed individuals must pay, covering Social Security and Medicare contributions.

Above-the-line Deduction

Deductions from gross income that are subtracted to calculate adjusted gross income on a tax return, potentially reducing taxable income.

Inexperienced Followers

Individuals who lack the knowledge, skills, or confidence to perform tasks without significant guidance or direction.

Environmental Influences

Factors or conditions in the surrounding environment that affect an individual's behavior, development, and life outcomes.

Q3: Turrubiates Corporation makes a product that uses

Q41: Brodrick Corporation uses residual income to evaluate

Q69: Familia Inc. reported the following results from

Q89: Agustin Industries is a division of a

Q100: Solly Corporation produces a product for national

Q121: Criner Inc. reported the following results from

Q217: The variable overhead efficiency variance measures the

Q241: The Bowden Corporation makes a single product.

Q263: Chimilio Clinic uses client-visits as its measure

Q408: During September, Clendennen Corporation budgeted for 24,000