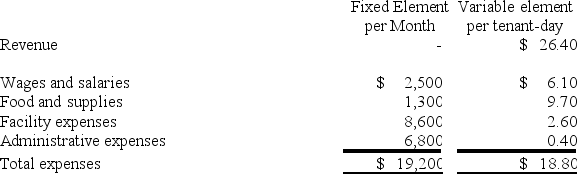

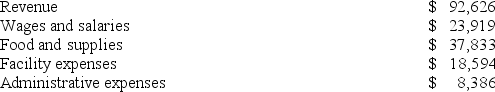

Virgen Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During May, the kennel budgeted for 3,700 tenant-days, but its actual level of activity was 3,690 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for May: Data used in budgeting: Actual results for May:

Actual results for May: The wages and salaries in the planning budget for May would be closest to:

The wages and salaries in the planning budget for May would be closest to:

Definitions:

Financing Cash Flow

Cash flow that is related to the financing of a company's operations, including debt, equity, and dividends.

Common Stock

A form of financial security that denotes part ownership in a company and entails a stake in the company's earnings or deficits.

Separate Entity Assumption

An accounting principle that treats a company as an independent entity separate from its owners for reporting purposes.

Q25: Pratte Boat Wash's cost formula for its

Q34: Fluegge Inc. has provided the following data

Q134: Bonkowski Corporation makes one product and has

Q139: The LaGrange Corporation had the following budgeted

Q139: A total of 6,850 kilograms of a

Q152: The following information relates to the direct

Q165: Medlar Corporation's static planning budget for June

Q295: Smith Corporation is a shipping container refurbishment

Q345: Mcdougald Corporation is a service company that

Q407: Hubbard Kennel uses tenant-days as its measure