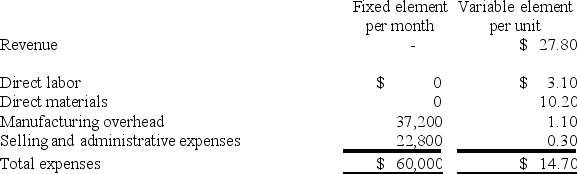

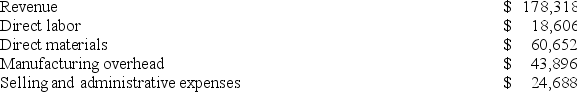

Trevorrow Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During June, the company budgeted for 6,200 units, but its actual level of activity was 6,160 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for June: Data used in budgeting: Actual results for June:

Actual results for June: The activity variance for net operating income in June would be closest to:

The activity variance for net operating income in June would be closest to:

Definitions:

Treynor's Measure

A performance metric for determining how well a portfolio has performed in excess of a risk-free rate, adjusted for the portfolio's risk.

Residual Standard Deviation

A measure of the amount of variance in a dataset or predictive model not explained by the model itself.

Beta

A measure of a stock's volatility in relation to the overall market; a beta above 1 is more volatile than the market.

Information Ratio

A measure of portfolio returns beyond the returns of a benchmark, typically used to assess the skill of a portfolio manager.

Q15: Rients Corporation is a service company that

Q90: Cannula Vending Corporation is expanding operations and

Q97: The Fime Corporation uses a standard costing

Q108: Doogan Corporation makes a product with the

Q124: Rogstad Corporation manufactures and sells a single

Q148: Kerekes Manufacturing Corporation has prepared the following

Q198: Wala Inc. bases its selling and administrative

Q212: Darke Corporation makes one product and has

Q264: Milot Corporation is an oil well service

Q373: Barrom Memorial Diner is a charity supported