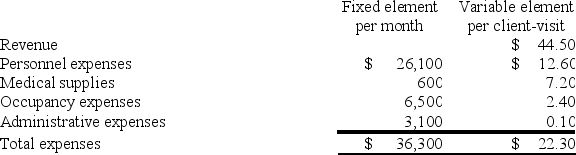

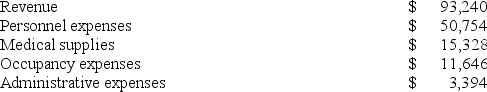

Bracken Clinic uses client-visits as its measure of activity. During September, the clinic budgeted for 2,100 client-visits, but its actual level of activity was 2,140 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for September: Data used in budgeting: Actual results for September:

Actual results for September: The revenue variance for September would be closest to:

The revenue variance for September would be closest to:

Definitions:

Overapplied

Refers to a situation where the allocated costs exceed the actual costs incurred, often seen in manufacturing and budgeting.

Manufacturing Overhead

All indirect factory-related costs associated with the production of a product, including costs related to indirect materials, indirect labor, and other overhead expenses.

Work in Process

Inventory representing partially completed goods that are still in the production process.

Underapplied

A situation where the allocated manufacturing overhead cost is less than the actual overhead costs incurred.

Q4: (Ignore income taxes in this problem.) Chipps

Q17: Michard Corporation makes one product and it

Q32: The LaPann Corporation has obtained the following

Q116: Ravena Labs., Inc. makes a single

Q180: Dibert Inc. has provided the following data

Q206: Benjamin Corporation is a shipping container refurbishment

Q234: The BRS Corporation makes collections on sales

Q236: Davis Corporation is preparing its Manufacturing Overhead

Q394: Leist Clinic uses client-visits as its measure

Q402: Dukette Memorial Diner is a charity supported