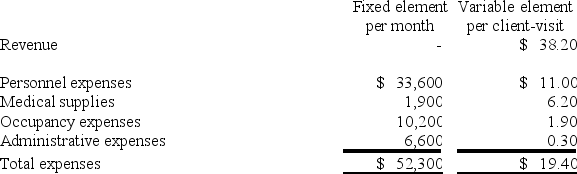

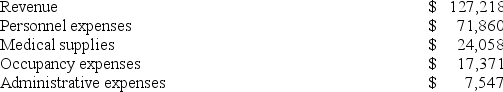

Bartosiewicz Clinic uses client-visits as its measure of activity. During January, the clinic budgeted for 3,500 client-visits, but its actual level of activity was 3,490 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for January: Data used in budgeting: Actual results for January:

Actual results for January: The net operating income in the flexible budget for January would be closest to:

The net operating income in the flexible budget for January would be closest to:

Definitions:

Cash Operating Costs

The expenses directly associated with the day-to-day operations of a business, excluding non-cash items like depreciation.

Payback Period

The duration of time it takes for an investment to generate cash flows sufficient to recover its initial cost.

Discount Rate

The discount rate that's critical in the process of valuing future cash flows today, within the framework of discounted cash flow analysis.

Net Present Value

A financial metric used to evaluate the profitability of an investment, calculated by subtracting the present value of cash outflows from the present value of cash inflows.

Q1: Devoto Inc. has provided the following data

Q2: Freytag Corporation's variable overhead is applied on

Q19: Michard Corporation makes one product and it

Q30: Grub Chemical Corporation has developed cost standards

Q39: Majer Corporation makes a product with the

Q62: If skilled workers with high hourly rates

Q76: Michard Corporation makes one product and it

Q154: The internal rate of return method assumes

Q210: Puvo, Inc., manufactures a single product in

Q214: Boan Tech is a for-profit vocational school.