Shaak Corporation uses customers served as its measure of activity. The company bases its budgets on the following information: Revenue should be $3.20 per customer served. Wages and salaries should be $21,000 per month plus $0.80 per customer served. Supplies should be $0.70 per customer served. Insurance should be $5,300 per month. Miscellaneous expenses should be $3,100 per month plus $0.10 per customer served.

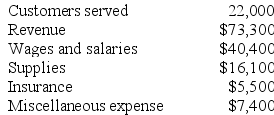

The company reported the following actual results for October:

Required:

Required:

Prepare a report showing the company's revenue and spending variances for October. Label each variance as favorable (F) or unfavorable (U).

Definitions:

Variable Costing

An accounting method that includes only variable production costs (materials, labor, and overhead) in product costs and treats fixed overhead costs as period costs.

Absorption Costing

An accounting method that incorporates all direct and indirect manufacturing costs into the cost of a product.

Net Profit

The total earnings of a company after subtracting all expenses, including taxes and operating costs, from its total revenues.

Variable Manufacturing Costs

Expenses that fluctuate with production output levels, including raw materials, direct labor, and utility costs directly involved in the manufacturing process.

Q2: Freytag Corporation's variable overhead is applied on

Q34: Schoening Corporation is a shipping container refurbishment

Q76: Gordin Kennel uses tenant-days as its measure

Q84: Luchini Corporation makes one product and it

Q103: Paragas, Inc., is considering the purchase of

Q122: The management of Hibert Corporation is considering

Q163: Dilly Farm Supply is located in

Q236: Cardero Midwifery's cost formula for its wages

Q268: Kaina Clinic uses client-visits as its measure

Q329: Bartosiewicz Clinic uses client-visits as its measure