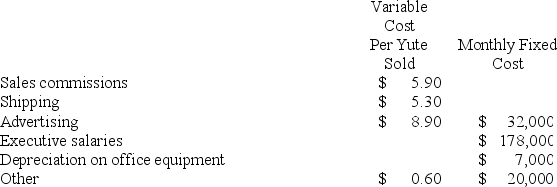

Porter Corporation makes and sells a single product called a Yute. The company is in the process of preparing its Selling and Administrative Expense Budget for the last quarter of the year. The following budget data are available:  All of these expenses (except depreciation) are paid in cash in the month they are incurred.

All of these expenses (except depreciation) are paid in cash in the month they are incurred.

If the company has budgeted to sell 12,000 Yutes in December, then the budgeted total cash disbursements for selling and administrative expenses for December would be:

Definitions:

Unique History

A distinct and unrepeatable sequence of past events or experiences particular to an individual, organization, or place.

IO Perspective

Stands for Industrial Organization Perspective, focusing on the behaviors, structures, and policies affecting industries, including competition and regulation.

Producer Surplus

The difference between what producers are willing to accept for a good versus what they actually receive.

Sustainable Competitive Advantage

A long-term business advantage that is not easily duplicable or surpassable by competitors.

Q4: (Ignore income taxes in this problem.) Chipps

Q9: Bruce Corporation makes four products in a

Q61: Nick Company has two products: A and

Q82: Cabe Corporation uses a discount rate of

Q84: Luchini Corporation makes one product and it

Q113: Litzinger Corporation makes one product. The ending

Q136: Eccles Corporation uses an activity-based costing system

Q139: (Ignore income taxes in this problem.) The

Q161: Houseal Corporation has provided the following data

Q186: The LaGrange Corporation had the following budgeted