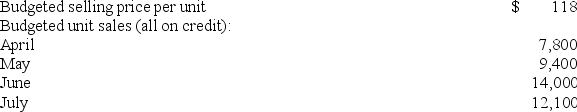

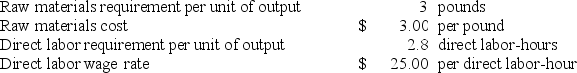

Hesterman Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:

Credit sales are collected:

Credit sales are collected:

40% in the month of the sale

60% in the following month

The ending finished goods inventory should equal 40% of the following month's sales. The ending raw materials inventory should equal 20% of the following month's raw materials production needs.

If 39,720 pounds of raw materials are required for production in June, then the budgeted cost of raw material purchases for May is closest to:

Definitions:

Deferred Income Tax

Income tax obligations that a company has accrued but not yet paid, appearing on the balance sheet as a liability.

Amortizable Capital Assets

Long-term assets whose cost is gradually expensed over their useful life, such as buildings and equipment.

Temporary Differences

Differences between the accounting value and tax value of assets and liabilities, resulting in deferred tax assets or liabilities.

Deferred Income Taxes

Taxes that are assessed or paid on income that is recognized in one period for financial reporting purposes but in a different period for tax purposes.

Q10: Morrel University has a small shuttle bus

Q10: A study has been conducted to determine

Q34: Schoening Corporation is a shipping container refurbishment

Q40: Fixed costs may be relevant in a

Q81: Capelli Hospital bases its budgets on patient-visits.

Q112: Scharfenberg Corporation is an oil well service

Q128: Catano Corporation pays for 40% of its

Q169: Rebelo Corporation is presently making part E07

Q183: A joint product is:<br>A) any product which

Q199: Hennagir Corporation makes one product and has