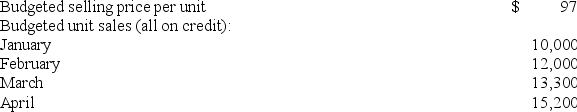

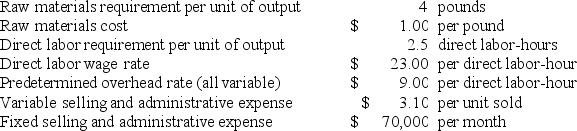

Bonkowski Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:

Credit sales are collected:

Credit sales are collected:

30% in the month of the sale

70% in the following month

Raw materials purchases are paid:

30% in the month of purchase

70% in the following month

The ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.

The expected cash collections for February is closest to:

Definitions:

Income Statement

A financial statement that shows a company's financial performance over a specific accounting period, detailing revenues, expenses, and net income.

Contribution Margin

The difference between sales revenue and variable costs of a product or service, indicating how much contributes towards covering fixed costs and generating profit.

Gross Margin

A financial measurement that calculates the difference between a company’s total revenue and the cost of goods sold, expressed as a percentage of total revenue.

Variable Costing

An accounting method that records variable costs (costs that change with production levels) as product costs, while fixed costs are recorded as expenses in the period they are incurred.

Q7: Glover Company makes three products in a

Q24: Wood Carving Corporation manufactures three products. Because

Q91: Prosner Corp. manufactures three products from

Q107: Marst Corporation's budgeted production in units and

Q132: The management of Elamin Corporation is considering

Q136: Mae Refiners, Inc., processes sugar cane that

Q155: Schriever Corporation is an oil well service

Q169: Mumbower Corporation makes one product and has

Q332: Spohn Clinic uses client-visits as its measure

Q408: During September, Clendennen Corporation budgeted for 24,000