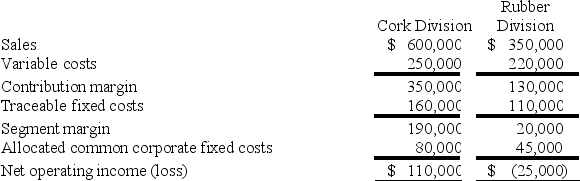

Vanik Corporation currently has two divisions which had the following operating results for last year:  Because the Rubber Division sustained a loss, the president of Vanik is considering the elimination of this division. All of the division's traceable fixed costs could be avoided if the division was dropped. None of the allocated common corporate fixed costs could be avoided. If the Rubber Division was dropped at the beginning of last year, the financial advantage (disadvantage) to the company for the year would have been:

Because the Rubber Division sustained a loss, the president of Vanik is considering the elimination of this division. All of the division's traceable fixed costs could be avoided if the division was dropped. None of the allocated common corporate fixed costs could be avoided. If the Rubber Division was dropped at the beginning of last year, the financial advantage (disadvantage) to the company for the year would have been:

Definitions:

Ownership

A legal right to possess, use, control, and dispose of an asset or property.

Minority Active Equity Investments

Investments in which a company has a small, non-controlling stake but is still actively involved in the management or operations of the investee company.

Equity Method

An accounting technique used by companies to record investments in other companies, where the investment is represented as an asset and changes in the investment's value are reflected in the investor's income.

Held-To-Maturity Debt Investments

Debt securities purchased with the intent and ability to hold until their maturity date.

Q16: Kanzler Corporation is considering a capital budgeting

Q62: Petrini Corporation makes one product and it

Q77: Leber Enterprises makes a variety of products

Q105: In a sell or process further decision,

Q136: Eccles Corporation uses an activity-based costing system

Q139: Drew Cane Products, Inc., processes sugar cane

Q145: Horgen Corporation manufactures two products: Product M68B

Q188: Porter Corporation makes and sells a single

Q190: How would the following costs be classified

Q195: The Carter Corporation makes products A and