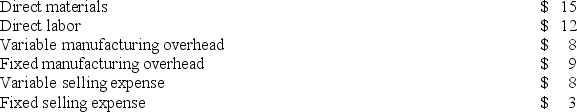

The Melville Corporation produces a single product called a Pong. Melville has the capacity to produce 60,000 Pongs each year. If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:  The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year. If Mowen Corporation offers to buy the special order units at $65 per unit, the annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Definitions:

Collateral

Assets pledged by a borrower to secure a loan or credit, which can be seized by the lender if the borrower fails to repay.

Bond Trustee

A financial institution appointed to oversee the interests of bondholders, ensuring the bond issuer meets all terms and conditions.

Bond Indenture

A legal contract between a bond issuer and a bondholder that specifies the terms of the bond, such as the interest rate, maturity date, and payment schedule.

Discount Amortization

The process of systematically reducing the discount on bonds payable over the life of the bonds, thereby increasing the carrying amount of the bonds.

Q6: Immen Corporation manufactures two products: Product B82O

Q33: Wedd Corporation uses activity-based costing to assign

Q58: Elfalan Corporation produces a single product. The

Q79: Tilson Corporation has projected sales and production

Q88: Departmental overhead rates will correctly assign overhead

Q101: A preference decision in capital budgeting:<br>A) is

Q102: Under variable costing, fixed manufacturing overhead is

Q123: Under the absorption costing method, a company

Q158: Plummer Corporation has provided the following data

Q252: Clemeson Corporation, which has only one product,