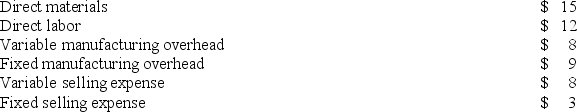

The Melville Corporation produces a single product called a Pong. Melville has the capacity to produce 60,000 Pongs each year. If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:  The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year. At what selling price for the 6,000 special order units would Melville be financially indifferent between accepting or rejecting the special order from Mowen?

Definitions:

FMVSS 121

United States Federal Motor Vehicle Safety Standard addressing air brake systems, aiming to ensure safety and reliability of braking in commercial vehicles.

Trailer Hand Control

A device installed in towing vehicles for manual control of a trailer’s brakes independently of the vehicle's brakes.

Service Brakes

The primary braking system used in vehicles for normal stopping operations, as opposed to auxiliary systems like parking or emergency brakes.

Foundation Brakes

The braking components downstream from the actuator that mechanically effect braking on a wheel. In a truck S-cam brake assembly, the foundation brakes consist of a slack adjuster, an S-camshaft, brake shoes, and a drum.

Q15: Acti Manufacturing Corporation is estimating the following

Q21: Which of the following costs are always

Q25: A customer has requested that Lewelling Corporation

Q28: Net operating income computed using absorption costing

Q72: Stoneberger Corporation produces a single product and

Q107: Suire Corporation is considering dropping product D14E.

Q127: A cost that would be included in

Q164: Which of the following would be an

Q177: (Ignore income taxes in this problem.) Ostermeyer

Q252: Clemeson Corporation, which has only one product,