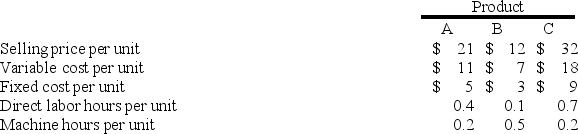

The Wester Corporation produces three products with the following costs and selling prices:  The company has insufficient capacity to fulfill all of the demand for these three products.

The company has insufficient capacity to fulfill all of the demand for these three products.

If direct labor hours are the constraint, then the ranking of the products from the most profitable to the least profitable use of the constrained resource is:

Definitions:

Medicare Taxes

Medicare Taxes are federal payroll taxes that fund the Medicare program, typically deducted from an employee's paycheck.

W-2 Form

A tax form issued by employers to employees detailing the employee's annual wages and the amount of taxes withheld from their paycheck, critical for preparing individual income tax returns.

Form 1040

The standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns.

Lookback Period

A set duration of time in the past during which relevant actions or financial transactions are reviewed for tax or regulatory purposes.

Q20: Diehl Corporation uses an activity-based costing system

Q40: Fixed costs may be relevant in a

Q58: To compute a product's profit or product

Q65: Data concerning three of the activity cost

Q79: Horgen Corporation manufactures two products: Product M68B

Q114: (Ignore income taxes in this problem.) The

Q133: Bonkowski Corporation makes one product and has

Q193: Bertsche Enterprises makes a variety of products

Q209: Direct labor costs are usually included in

Q224: Tat Corporation produces a single product and