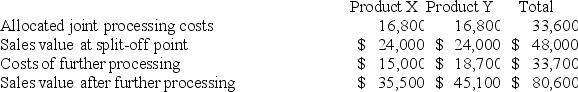

Dock Corporation makes two products from a common input. Joint processing costs up to the split-off point total $33,600 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:  What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

Definitions:

Overtime

Additional time worked by an employee beyond the normal or legally defined working hours, often eligible for higher pay rates.

Sensitivity Analysis

The study of how the variation in the output of a model can be attributed to different variations in its inputs.

Scarce Resources

Limited resources available to meet the unlimited wants and needs of individuals or societies.

Parameter Changes

Adjustments made to the variables or inputs that define the operation of a system or model.

Q26: Some investment projects require that a company

Q92: Boney Corporation processes sugar beets that it

Q95: Paragas, Inc., is considering the purchase of

Q140: A product whose revenues do not cover

Q157: Mccrone Corporation has provided the following data

Q173: Consider the following production and cost data

Q212: Variable costing is more compatible with cost-volume-profit

Q244: Moskowitz Corporation has provided the following data

Q261: Lean production should result in reduced inventories.

Q288: Neef Corporation has provided the following data