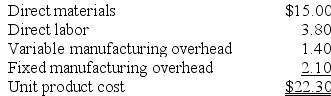

Wehrs Corporation has received a request for a special order of 6,000 units of product K19 for $32.30 each. The normal selling price of this product is $33.45 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product K19 is computed as follows:

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $4.90 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $4.90 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order. Show your work!

Definitions:

Total Assets

The sum of all assets owned by an entity, including both current and non-current assets, as recorded on the balance sheet.

Total Asset Turnover

A financial ratio that measures a company's effectiveness in using its assets to generate sales or revenue.

Full Capacity

The highest amount of production a business can maintain for an extended time without needing to raise its fixed expenses.

Capacity

The maximum level of output that a company can sustain to make a product or provide a service, taking into account current resources and facilities.

Q26: The book value of an old machine

Q60: Lenart Corporation has provided the following data

Q72: Ryner Corporation is considering three investment projects:

Q86: Arrojo Corporation manufactures two products: Product X71B

Q105: In a sell or process further decision,

Q111: Flemming Corporation uses activity-based costing to compute

Q118: Companies often allocate common fixed costs among

Q166: Deemer Corporation has an activity-based costing system

Q178: Jemmott Corporation has two divisions: Western Division

Q185: Meli Corporation manufactures two products: Product L61P