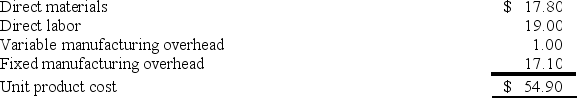

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 70,000 units required each year? (Round your intermediate calculations to 2 decimal places.)

Definitions:

Earth Friendly

Describes practices, products, or technologies that are not harmful to the environment and often contribute to sustainability.

Self-grounding

A technique used to prevent electrostatic discharge (ESD) by touching a grounded object before handling sensitive electronic components.

Shock

A sudden and intense disturbance or impact, which can be physical, electrical, or emotional in nature.

Surge Strip

A device designed to protect electronic equipment from voltage spikes by blocking or shorting to ground any unwanted voltages above a safe threshold.

Q14: The first-stage allocation in an ABC system

Q28: Net operating income computed using absorption costing

Q44: Dilly Farm Supply is located in

Q54: The management of Lanzilotta Corporation is considering

Q61: (Ignore income taxes in this problem.) Ramson

Q83: The Puyer Corporation makes and sells only

Q89: Mcinture Enterprises makes a variety of products

Q139: (Ignore income taxes in this problem.) The

Q180: The Bandeiras Corporation, a merchandising firm,

Q193: Assuming the LIFO inventory flow assumption, when