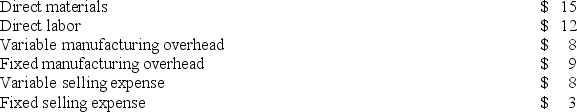

The Melville Corporation produces a single product called a Pong. Melville has the capacity to produce 60,000 Pongs each year. If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:  The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year. If Mowen Corporation offers to buy the special order units at $65 per unit, the annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Definitions:

Cash Cow

A business, investment, or product that consistently generates significant amounts of cash flow or profit, often requiring little maintenance.

Making Money

The process of earning a profit or income, typically through business activities, investments, or employment.

Spending Money

The act of using cash or credit to purchase goods or services, often reflecting the consumption habits of individuals or organizations.

Management Buyout

An acquisition strategy where the existing managers of a company buy a significant part or all of the company from its owners or its parent organization.

Q19: Danahy Corporation manufactures a single product. The

Q23: The management of Wengel Corporation is considering

Q50: The controller of Hendershot Corporation estimates the

Q96: Columbia Corporation produces a single product. The

Q113: Fletes Corporation manufactures two products: Product O95C

Q123: Under the absorption costing method, a company

Q165: Aaron Corporation, which has only one product,

Q184: Mirabile Corporation uses activity-based costing to compute

Q227: Petrini Corporation makes one product and it

Q252: Clemeson Corporation, which has only one product,