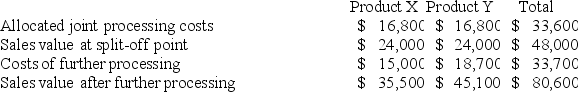

Dock Corporation makes two products from a common input. Joint processing costs up to the split-off point total $33,600 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:  What is the financial advantage (disadvantage) for the company of processing Product X beyond the split-off point?

What is the financial advantage (disadvantage) for the company of processing Product X beyond the split-off point?

Definitions:

Variable Cost of Goods Sold

Expenditures that fluctuate in direct relationship with the amount of goods produced or sold, for instance, materials and labor costs.

Gross Profit

The difference between sales revenue and the cost of goods sold, indicating the efficiency of a company's core operations.

Fixed Costs

A repetitive charge that does not fluctuate with the volume of business activity, including expenses like lease payments and utility bills.

Contribution Margin

The amount of revenue remaining after deducting variable costs, used to cover fixed costs and generate profit.

Q44: A company is considering buying a machine

Q60: Marty's Merchandise has budgeted sales as follows

Q77: Leber Enterprises makes a variety of products

Q89: Mcinture Enterprises makes a variety of products

Q104: Hesterman Corporation makes one product and has

Q106: Nissley Wedding Fantasy Corporation makes very elaborate

Q166: Benjamin Company produces products C, J, and

Q166: Deemer Corporation has an activity-based costing system

Q199: Farris Corporation, which has only one product,

Q202: Bonkowski Corporation makes one product and has